Slippage on Solana: What it really tells us

Slippage is a fundamental parameter of decentralized finance. It reflects market dynamics, execution quality, and exposure to systemic risk. Understanding it is key to mastering DeFi strategy.

⌜Introduction⌝

Slippage is a key concept in decentralized trading, especially on Solana, a blockchain known for its high speed and highly competitive environment. It refers to the difference between the expected price of a transaction and the actual price at which it is executed.

Example:

→ You want to buy a token at $1.00

→ You end up paying $1.02

→ Slippage = 2%

❌ Without slippage tolerance: the transaction fails

✅ With slippage tolerance (ex 2%): the transaction goes through, but at a slightly higher costWhile often minimal, slippage can become a significant risk if not properly managed particularly in a high-speed, competitive DeFi environment like Solana's.

⌜Importance of slippage on Solana⌝

Slippage is necessary because prices on a DEX fluctuate in real time. It allows:

[Trades to be executed despite market volatility]

The price can change between the moment you sign the transaction and when it is confirmed on-chain.

Without slippage tolerance, transactions would fail too frequently.

[Let users choose their preferred level of risk]

Low slippage = more security, but higher risk of transaction failure

High slippage = guaranteed execution, but potentially worse pricing

[Prevent “optimistic” errors]

You set an acceptable margin of error (e.g. 0.5%).

The protocol won’t execute the swap if the actual price exceeds that margin.

[Low liquidity pools]

With low-liquidity tokens or newly launched liquidity pools, a large transaction can significantly impact the price

High slippage, potential loss.

[Protection against losses]

Slippage is your safety belt. It limits how much you're willing to lose due to market movement, not because of the token itself.

⌜Maximal Extractable Value⌝

[Arbitrage]

Arbitrage bots serve a regulatory function.

By adjusting prices across multiple liquidity pools, they narrow quote spreads and reduce slippage for subsequent trades. Their presence is structural: by exploiting imbalances, they enhance market efficiency and contribute to price alignment.

[Sandwich]

By leveraging private mempools, some bots insert transactions before and after a targeted trade (frontrun + backrun), artificially inflating the user’s cost. While this strategy represents a small share of total MEV profit, it increases slippage for profit and directly degrades the user experience.

⌜Slippage & Account ⌝

On Solana, data is passed through accounts. As a result, each transaction includes:

Instructions

And the accounts associated with those instructions

So the information “I want at least 4.95 SOL” is stored in a field (or an associated account) of the transaction. These values are encoded in the transaction it self not just in the web app’s frontend.

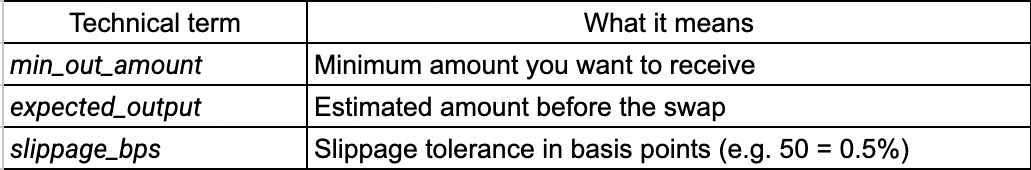

Allowed slippage = what you're willing to tolerate (

min_out)Observed slippage = what you actually got (difference between estimated and actual price)

⚠️ Risk ⚠️

If slippage were set only in the frontend (user interface), then:

A bot could intercept the transaction

And execute your swap at a bad price

Encoding min_out_amount inside the transaction ensures the swap only executes if the minimum is met.

➡️ The program will refuse to execute the swap if this minimum isn’t met.

So you’re protected directly on-chain.

You want to swap 100 USDC → you expect to receive 5.00 SOL

You set a 1% slippage tolerance → meaning 4.95 SOL minimum

In the transaction:

Jupiter or Raydium encodes min_out = 4.95

If the market moves and the swap gives you 4.92 → ❌ the program cancels the execution

If you receive 4.96 → ✅ the swap is accepted⌜Private transaction⌝

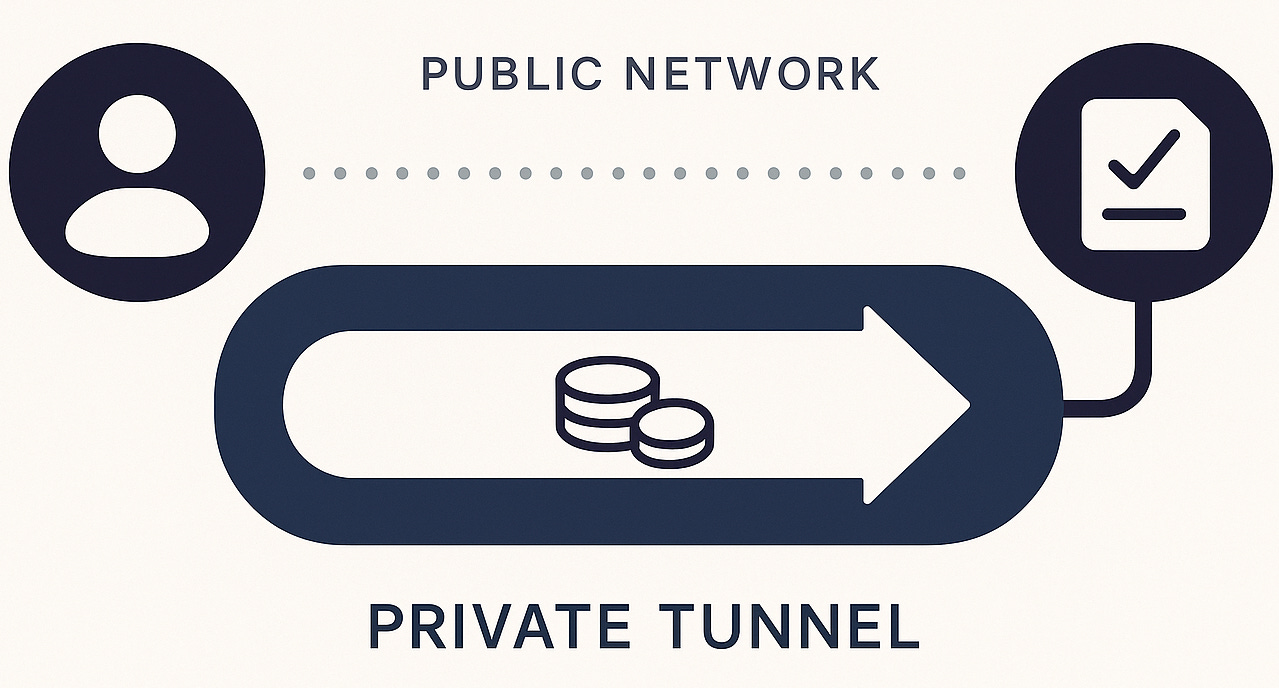

It is not a Solana on-chain program, system instruction, or native protocol. Here’s exactly what it is, what it isn’t, and how it fits into the ecosystem:

An off-chain infrastructure service designed to protect user transactions from MEV attacks, such as sandwich strategies.

Operated by entities like Circular.fi, it relies on a network of compatible validators similar to FAST relayers.

It acts as a private relayer or "private transaction tunnel."

Some API (e.g. FAST) offer a private transaction option that routes trades directly to a partner validator, bypassing standard propagation paths like public RPCs or broadcast networks.

The goal is to prevent bots especially those using validator-integrated setups from seeing or front-running the transaction before execution.

In the Fast documentation example, this command allows you to execute a transaction, either protected or unprotected against MEV attacks.

frontRunningProtection: false, ⌜New Paradigms: Slippage-Free DEXs⌝

Toward slippage-free DeFi on Solana?

Slippage is currently a core element of decentralized trading, but several experimental projects on Solana are aiming to eliminate it entirely by rethinking how exchanges operate. Two stand out for their innovative approach: Soliquid and Gavel.

Still in the prototype phase, these projects rely on complex systems combining virtual order books with atomic matching.

Trade intents remain private until execution.

This discreet execution model is drawing the attention of the MEV research collective on Solana.

Although not yet widely adopted, these projects reflect a deeper trend in DeFi,

aiming to eliminate slippage not through user settings, but by designing a new generation of DEXs where slippage is no longer managed it’s structurally removed.

These experiments are still in early stages, but they raise important questions about the future of decentralized trading:

Will slippage remain a fundamental parameter ?

Or will it be absorbed by fairer but more complex protocol designs?

⌜Data Analytics⌝

What Slippage Reveals About DeFi Markets on Solana

In a fast and fragmented environment like Solana, slippage isn’t just a side effect of trading.

For a tool like Circular.fi, it can surface on-chain insights such as:

A key factor in arbitrage analysis (was the trade still profitable after slippage?)

A metric for DEX swap efficiency

A signal of MEV bot activity

⌜Final Summary⌝

Slippage is both a user risk, a MEV opportunity, and a sign of inefficiency in Solana-based DEXs.

It can be analyzed with high precision, block-by-block, transaction by transaction to detect stress points or potential attacks.

Defensive strategies include strict

min_outsettings, private transactions, and smart tipping.New models are emerging to eliminate slippage by design, such as Gavel and Soliquid.

At Circular.fi, slippage is viewed as a behavioral, tactical, and strategic signal, valuable across all levels: user, trader, arbitrageur, and builder.

🙏 Thank you for reading and for your support. If you find our work valuable,

🔂 Share it and follow us to stay updated with the latest insights and analysis.

🌐 Explore solutions on our website Circular.fi .

🔗 Join our community on Discord, follow us on X @Circular.fi, and Telegram .

👋 See you soon for more updates!