Bam the new way, of Solana capital market

Jito BAM is revolutionizing Solana's capital markets. This mechanism transforms network activity into a novel revenue stream, directly rewarding its participants.

⌜Introduction⌝

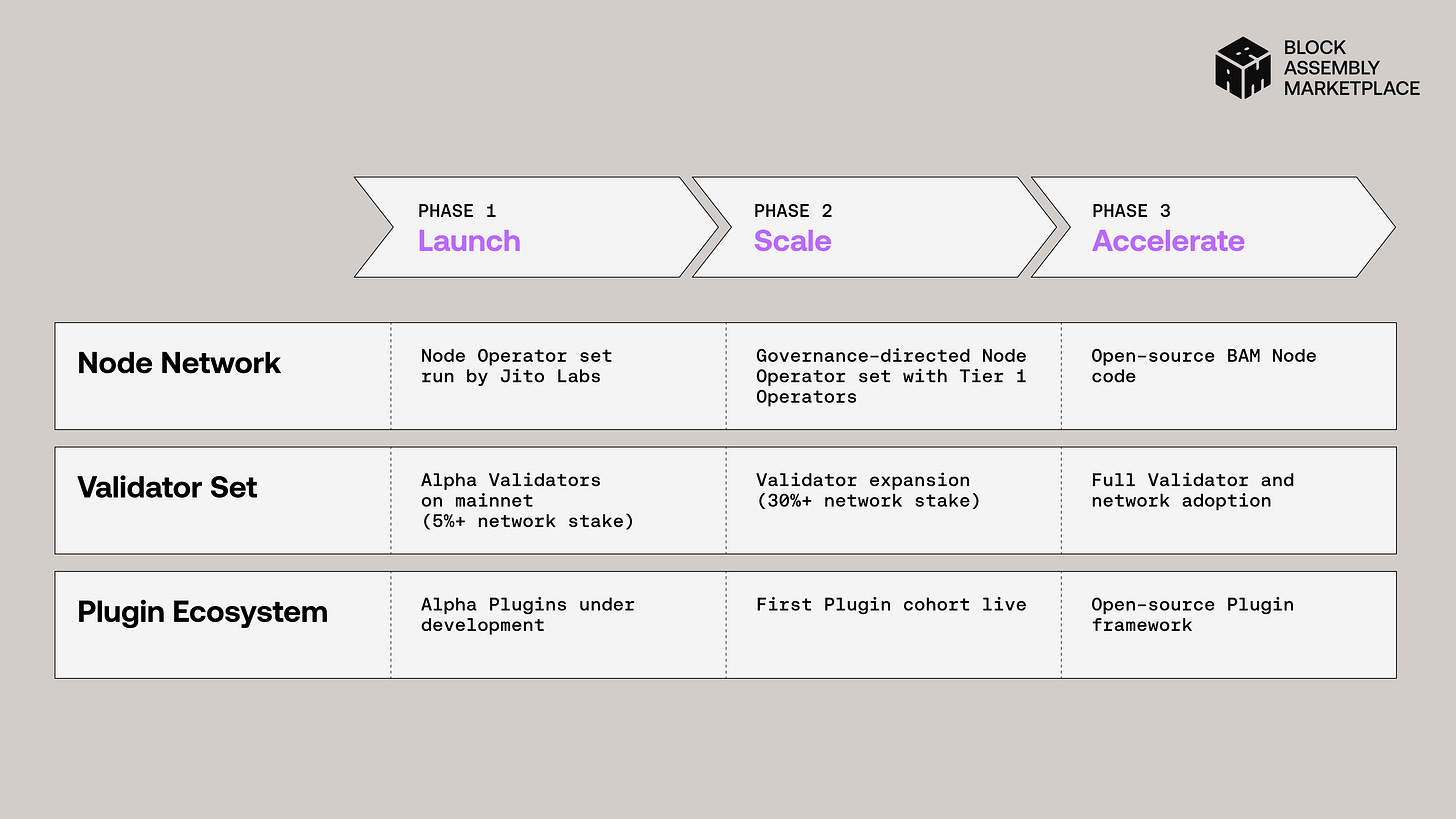

At the end of 2024, Jito Labs, supported by the Jito Foundation, launched the development of the Block Assembly Marketplace (BAM). As Jito Labs CEO Lucas Bruder explained, the initiative addresses a critical need: bringing greater determinism and transparency to the ordering of transactions within a single slot.

⌜What’s Jito⌝

[Jito Labs]

Jito Labs is a core Solana development team focused on improving transaction execution and managing Maximal Extractable Value (MEV) transparently. They developed the Jito-Solana client, an enhanced validator client with advanced MEV features like bundle aggregation and revenue sharing.

Jito Labs also developed the Block Engine, which enables searchers to submit optimized transaction bundles. Jito Labs is the technical team building the infrastructure and tools around MEV on Solana.

[Jito Foundation]

The Jito Foundation is a non-profit organization that supports the Jito ecosystem and the broader development of MEV solutions on Solana. It acts as the community governance body and funding arm, ensuring that MEV capture and redistribution remain transparent, fair, and decentralized.

The foundation is partly governed through the $JTO token, which allows holders to participate in proposals and decision-making for the future of the ecosystem. In essence, the Jito Foundation is the governance and community-driven entity that steers the long-term growth of Jito’s innovations.

⌜Solana Blockchain⌝

[Problem]

In Solana’s current blockchain, transaction sequencing has suffered from a lack of clarity and fairness. Leader validators could freely reorder transactions without enforced rules or proofs of intent. Only the finalized block was visible, with no record of which transactions had been reordered or dropped.

As a result, traders and liquidators were exposed to frontrunning and backrunning, practices that fuel harmful sandwich attacks. This degraded execution quality and led to unfavorable prices.

Note: For a deeper explanation of sandwich attacks on Solana, check out our dedicated article on the topic.

[Solution by Jito Labs]

The Block Assembly Marketplace (BAM) redefines Solana’s market structure. According to a press release shared with CoinDesk, it is designed to make transaction sequencing “transparent and verifiable.”

BAM also creates new revenue streams for developers and reduces the impact of harmful MEV. BAM introduces three major innovations:

Verifiable fairness: sequencing that is fully traceable and auditable.

Programmable blockspace: developers can create custom sequencing rules.

New revenue streams: applications can implement personalized fee models, benefiting developers, validators, and stakers alike.

⌜Technical Architecture⌝

[BAM Validators]

These are the validators running the updated Jito-Solana client. Their role is to execute the transactions delivered by BAM Nodes in the defined order.

[BAM Nodes]

It is a network of scheduler nodes using Trusted Execution Environments (TEEs). These secure enclaves sequence transactions while ensuring confidentiality and verifiability. TEEs function like “black boxes”: they rank and simulate transaction bundles without revealing sensitive data. This protects traders’ private strategies while still allowing validators to verify the results.

[Plugins]

Plugins are programmable interfaces that allow developers, traders, and applications to define their own sequencing logic. They introduce a new economic model:

Developers can monetize their custom logic.

Validators, node operators, and stakers share the value generated through a built-in redistribution system.

BAM thus transforms blockspace into an open sandbox, enabling the design of modular applications and new market models. For example, CLOBs (Central Limit Order Books) can be implemented within BAM, with deterministic and transparent execution that combines both on-chain and off-chain logic.

⌜BAM and MEV impact⌝

Maximal Extractable Value (MEV) is at the core of BAM’s design.

Reducing harmful MEV: BAM mitigates frontrunning, sandwich trading, and liquidation backruns, which previously undermined user trust.

Encouraging useful MEV: arbitrage, which improves market efficiency, becomes more seamless and transparent.

Ensuring fair access: BAM offers a programmable and open path to capture MEV, without validator collusion or private agreements.

[Sandwich]

Before BAM

Based on mempool visibility and validator reordering.

Attackers front-run and back-run user trades.

Users pay worse prices, value extracted by sandwichers.

After BAM

Transactions are encrypted → no visibility for opportunistic attacks.

Verifiable order → no hidden reordering.

Only transparent logic via plugins is allowed.

➡️ Toxic MEV sandwiches is “neutralized”.

[Liquidation]

Before BAM

Speed races between bots → massive spam and wasted resources.

Gas wars raise costs for everyone.

Unfair ordering possible, depending on validator behavior.

After BAM

Encrypted tx → no mempool leaks, liquidations triggered purely from on-chain state.

Verifiable order → bots can’t be unfairly pushed back.

Protocols can design liquidation plugins (e.g. best discount, priority rules).

➡️ Liquidations remain, but become cleaner, fairer, cheaper, and protocol-driven.

[Arbitrage]

Before BAM

Arbitrage bots rely on speed and spam to capture price gaps.

Occasional unfair reordering could distort outcomes.

High competition wastes compute units.

After BAM

Encrypted transactions prevent sniping opportunities.

Verifiable order ensures fair sequencing of arbitrage trades.

Plugins can support new forms of cross-DEX or JIT arbitrage in a transparent way.

➡️ Arbitrage survives, but evolves into smarter, transparent, and more efficient strategies.

⌜Perspectives of Solana with BAM⌝

BAM brings Solana closer to a model where validators no longer order transactions themselves but instead select the most relevant pre-built blocks. This opens new opportunities for the ecosystem but also creates greater reliance on a smaller set of builders — making transparency and fair access absolutely essential.

For Solana, which aspires to become the financial ledger of the internet (or, as the community often calls it, the “Solana capital market”), BAM represents a strategic advancement. By allowing applications to define their own fee models, it transforms sequencing into a direct source of profit. If these revenues are redistributed to token holders, it could trigger a massive revaluation of many assets and drive a profound reshaping of Solana’s DeFi landscape.

⌜Final Summary⌝

The launch of BAM marks a major milestone in Solana’s evolution. With more transparent execution, programmable blockspace, and a new revenue-sharing model, the ecosystem is entering a phase of maturity.

As Lucas Bruder, CEO of Jito Labs, summarized:

“BAM opens up an entirely new design space for developers to build applications that weren’t possible before. It gives builders more control, creates new ways to generate and share value, and lays the groundwork for a more dynamic, composable blockspace economy on Solana.”

BAM does more than simply address past inefficiencies; it redefines the foundations of decentralized finance on Solana and paves the way for a fairer, more innovative, and more sustainable blockspace economy.

🙏 Thank you for reading and for your support. If you find our work valuable,

🔂 Share it and follow us to stay updated with the latest insights and analysis.

🌐 Explore solutions on our website Circular.fi .

🔗 Join our community on Discord, follow us on X @Circular.fi, and Telegram .

👋 See you soon for more updates!